Accountants Are Not All Apples

One of the greatest challenges we hear from prospective customers is to understand what we deliver to our customers and being able to compare that to other accounting options they have discovered.

Basis 365 was created to deliver a unique, outsourced accounting experience to small businesses by providing a virtual accounting department using cloud-based accounting applications. Many business owners didn't even know this existed and were comparing our pricing against bookkeepers or CPA firms and not understanding why there were such extremes.

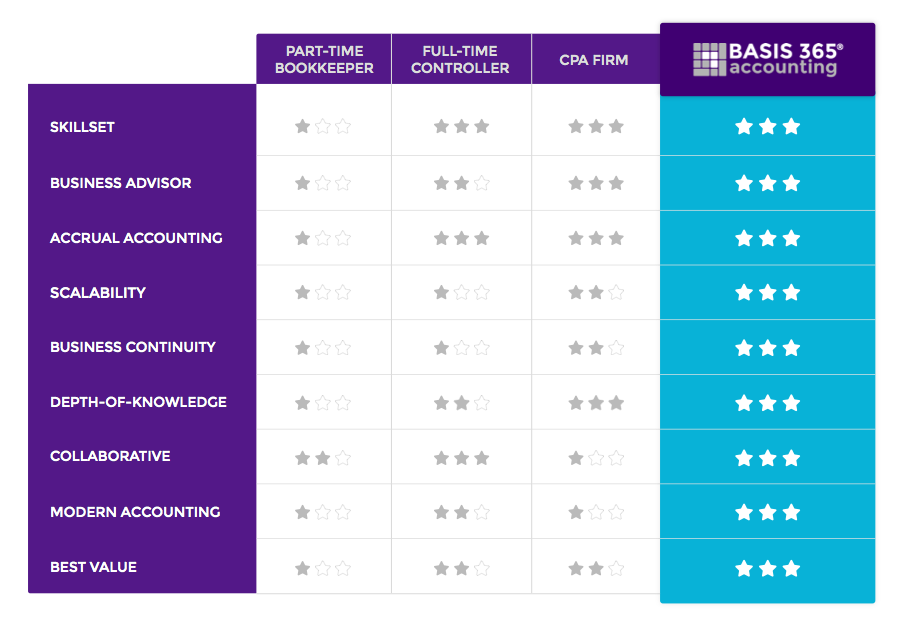

We've created a helpful chart to understand the pros and cons of the options as we see them. Not only has this exercise been useful for prospective customers, we found it useful internally to ensure we continue to hit full stars in these critical areas. We have previously written a blog about each of the three alternative options in more detail that may be of use.

Applicable for small businesses ranging from $1mm - $20mm in annual revenue or from 5-100 employees.

Although we love the simplicity of the above chart, we understand that some of the terms listed may not be intuitive to everyone. You'll find a deeper dive in to each item we scored below.

Skillset

Growing businesses require employees to wear multiple hats. Running an accounting department involves basic bookkeeping knowledge to code simple transactions, college-educated accounting knowledge for proper accruals, and controller-level skills for budgeting/forecasting. Although that's a simplified description you can see the challenge.

Business owners have a few options to consider:

Bookkeeper: Save money and hire the lowest skillset required. This limits the business's ability to grow as that person will be unable to handle higher-level tasks. The bookkeeper-only option will be part of the bottleneck of the business's growth.

Controller: Pay for the highest level of skills required. You now have a highly-educated professional performing low-level tasks. They'll enjoy the more complex work and will be bored out of their mind on the low-level. They won't see much room for professional growth unless you have them tied to equity.

CPA firm: CPAs are generally going to be the most expensive option. Although very highly trained, they tend to bill by the hour, discouraging you from speaking to them to avoid surprise invoices and tend to only handle the books for their customers to keep their tax professionals busy. Come tax season, you'll find it hard to get in contact with them regarding your books.

Basis 365: We are not a CPA firm and therefore do not have a "busy season" where customer service wanes. Our customers have a team of 2-3 with skill sets appropriate for the work being performed. This blended approach is the best of both worlds. The only way to replicate this approach yourself is to hire a part-time team for each level in your accounting department which isn't easy. You won't find many people who are willing to work part-time for any length of time for each accounting function.

Business Advisor

Accountants are usually pigeon-holed as either tax preparers or bookkeeping bean-counters. The industry tries to change this perception but the problem still exists. For a business with one owner, bean-counting may be enough. When the business grows to 7 figures and you've hired more than a few employees, things change.

Your financials are no longer just telling you what's in the bank but can tell you what may be coming in the future. They are starting to tell a story about the business. Your accountant should be able to tell you that story and talk about what areas you can change to improve business performance.

Bookkeeper: Being at the lower level of skill, companies will find it hard to find a bookkeeper that can provide such insight. It is difficult, if not impossible, to start running scenarios without proper accrual accounting. Bookkeepers tend to understand some of the basics of accruals, such as Accounts Receivable but often don't have a degree in accounting where those concepts are expanded upon.

Controller: Qualified Controllers should have a solid understanding of accruals and in helping budgeting/forecasting activities. We say qualified as there are many bookkeepers that have been given the Controller or CFO titles that are not really performing the accounting tasks typically attributed to that title.

We have assigned 2-stars to this role because, although they have the accounting chops, they may not have experience in running a business and may lack on providing business advice being the accounting. Many accounting professionals prefer to stick to the numbers and shy away from painting a broader picture.

CPA firm: CPA's should, within the firm as a whole, be able to deliver business advice beyond the numbers.

Basis 365: Similar to a CPA firm, we work across 100s of customers and have built up a collective knowledge to provide helpful advice in many areas. Although we are not experts in all areas, such as HR or business law, we see enough to identify areas to consider and recommend experts where needed.

ACCRUAL ACCOUNTING

Accrual accounting is an underrated accounting term that is not well known outside the industry. Without getting into an in-depth explanation, which it deserves, the overall concept is to try to match revenues with expenses so that the financials show some level of consistency.

A simple example is Accounts Receivable. Cash-basis accounting will record the revenue when the deposit hits the bank. If you perform the service now and get paid 3 months later, having that revenue hit three months from now when you incurred the expense of performing that work today would result in unhelpful financial statements.

That example is logical and makes sense to non-accountants. There are many others that are more arbitrary that a qualified accounting will record. It's hard to budget or utilize trend analysis without accrual financials. This is why we utilize accrual accounting for all of our customers.

Bookkeeper: Expect to see common accruals like Accounts Receivable and Accounts Payable. They may properly accrue payroll or notes payable.

Controller: Controllers should pick up almost all accruals. Possible exceptions may be the most complicated GAAP accruals that revolve around financing or equity transactions.

CPA firm: CPAs should be capable of full GAAP accrual financials.

Basis 365: Accrual accounting is at the core of what we do.

SCALABILITY

Small businesses, especially those in the tech or e-commerce space, can grow rapidly. Translating that into the accounting, utilizing cloud-based applications that integrate with each other is key to a scalable solution.

Similarly, the team working on your accounting will require certain skills as the business changes. Everything we do is about automation and constant refinement. Our goal is to eliminate manual inputs to reduce error and allow the business to expand or contract with limited impact on what we do and the related costs.

Bookkeeper: Will be most comfortable using Quickbooks’ desktop software, will be expecting to come on site to process paper-based transactions, tend to just learn how you’ve always done things, and will be a team of one. As the accounting requirements increase, they will not be able to grow with you. Many part-time bookkeeper experiences end with the bookkeeper just not showing up for work.

Controller: Exactly the same challenges as the Bookkeeper model except they will give you 2-3 weeks of notice before leaving. Working on more complex financials, they tend to not document procedures or maintain proper GL reconciliations. Things are “in their head” and are hard to transition to a new person.

CPA firm: Also very comfortable on Quickbooks desktop and other older software applications. CPA’s are known to “do things the way they’ve always done them” and do not adapt well to change. Even if they say they use Xero, they most likely have 75% or more of their customers on Quickbooks. CPA firms do have a staff of accountants so they can ramp up team members if needed.

Basis 365: We maximize cloud application integration and are constantly researching new technology solutions to ensure the accounting can evolve with the business. We can bring on team members for certain functions as needed or ramp down if that’s the unfortunate situation the business is in.

BUSINESS CONTINUITY

One of the more common scenarios that force business owners to contact us is that their current accountant is leaving or stopped showing up. Two-to-three weeks notice is not a lot of time find a replacement and get them trained. This is especially true when the transition requires the outgoing accounting to “explain” everything to the new hire from memory.

Business owners don’t want to be in this situation again and are looking for an alternate solution to hiring.

Bookkeeper: The least reliable of all options, bookkeepers will not solve this challenge. This group is most likely to just no-show, leaving everything at a standstill.

Controller: The most common option of offering 2-3 weeks to find and train a replacement. Posting a replacement, coordinating interviews and making the right choice usually runs beyond 2 weeks, leaving you very little time for training.

CPA firm: CPAs do tend to document well. The challenge here is that many CPA firms only do bookkeeping to keep the tax staff busy when there are no tax returns to file. CPA firms make 80%+ of their revenue on tax work so don’t expect your books to take priority over that. Expect to see your CPA go MIA during Feb-Apr and Aug-Oct.

Basis 365: We only offer outsourced accounting services. There is no busy season to distract us from your accounting. Our customers have a multi-member team with documented procedures so we can drop in a new team member painlessly.

Depth-of-Knowledge

Accounting is a very broad field. No accountant knows everything. The internet is a powerful tool that allows anyone to quickly research areas they are not familiar with and learn what is needed. This can sometimes result in incorrect interpretation or utilizing research that isn’t correct or isn’t really the answer to the problem you’re trying to solve.

It is helpful for accountants to discuss situations and work out a collective answer, pooling everyone’s knowledge for the benefit of a customer.

Bookkeeper: Being one person, they are limited to the knowledge they can gain from the internet or perhaps other bookkeepers if they maintain a network. Bookkeepers can assist with basic business tasks but generally do not think like a business owner and therefore sticks to the books.

Controller: Similar to Bookkeepers although they have a much deeper understanding of accounting principles. Their research capabilities should be better but are limited to their own knowledge. Most tend not to maintain a network to pull from and simply go job to job as a solo act.

CPA firm: Firms have a very deep pool of knowledge and should be capable of providing a broad range of value.

Basis 365: Similar to a firm, we have a large team that collaborates daily with our customers and each other. Our culture engrains the sharing of knowledge in everything we do. Whether it’s an accounting topic, small business question, or software application query, we have learned to ask and share to build a more knowledgeable team.

Collaborative

Growing businesses should be working hand-in-hand with their accounting team. Things come up and need to be addressed quickly. Business owners look to their accountant to play an active role in the business, making suggestions along the way.

Bookkeeper: Many bookkeeping-only arrangements require the person to come in weekly. It is hard to collaborate effectively in such small bursts of time. For businesses that have a full-time Bookkeeper, the collaboration should be much higher.

Controller: Full-time employees should be very collaborative considering they are onsite and there for long periods of time.

CPA firm: Most firms tend to bill hourly and therefore any collaboration that takes place results in a bill. This encourages the business owner and their team to only ask the accountant for things they need and no more. That business model discourages real collaboration.

Basis 365: Our team looks at themselves as an extended part of your team. We want to be a part of the adventure or story of the business. With our fixed pricing model and processing of transactions in real-time, there is no need to limit conversations with our team. Our team is encouraged to chat with our customers to really understand what they are thinking and where the business should be going.

Modern Accounting

Like every other industry, business is changing at a rapid pace. The accounting industry is no different. The traditional paper-based, desktop software accountant is a thing of the past yet a majority of the accounting you may run across as still living there. The industry is notorious for being late technology adopters.

Instead of finding a tax preparer who also does books, business owners want an accounting partner that is engaged and adding value to the success of the operation. Finding an accounting partner that utilizes the most current technology and creating a unique experience should be a top priority for a rapidly growing business.

Bookkeeper: Considering Bookkeepers tend to use whatever is in place, which is usually Quickbooks with some outdated procedures, you shouldn’t expect them to revolutionize your accounting experience with an accounting stack of cloud-based applications and revamped workflows.

Controller: Having a deeper understanding of accounting and commonly full-time, a Controller should be capable of improving processes to generate accurate financials. Still, being an accountant, this person is most likely not very tech-savvy and will stick to the status quo on software.

CPA firm: CPA’s have the budget and team that should allow them to provide a modern experience. Lack of technology skills still abound within firms and the partnership-based business model makes it hard for firms to adopt technologies quickly due to the need for partner consensus. Since most CPA firms that do bookkeeping are primarily tax shops, bookkeeping tends to lag behind and is shelved during tax season. Not very modern in our eyes.

Basis 365: We focus 100% on cloud-based, outsourced accounting. We live in the cloud and are always testing new applications on the market and tweaking procedures for constant improvement. We focus on industries that we know well so we can deliver an amazing accounting experience.

Best Value

Which option is the biggest bang for your buck? This doesn’t mean which is cheapest. It means which option covers all of the bases to ensure your accounting team is adding the most value to your business.

Bookkeeper: The cheaper option but limited skillset will hold back a growing business.

Controller: Highly skilled and boots on the ground should result in accurate numbers. Being an employee, you are limited to a team of one that costs more than most business owners think. You are limited to the capabilities of this one person.

CPA firm: A deep talent pool allows a firm to handle any complex accounting issue. Most firms bill at 3x or more of their costs and bill hourly so this is the most expensive option. Business model means service levels tend to drop during tax season in the spring and the fall.

Basis 365: A solid blend of collaboration, scalability, and knowledge yields the ultimate accounting experience. We focus on telling the story of a business through the financials and help business owners build a financially solid business that can sustain growth.