Cash is King: Why Cash Flow Matters for Your Business

Robust and predictable cash flow could be the only thing standing between you and insolvency. Like gas in the tank, you can only make it so far before you need to refill.

Here’s why cash flow matters so much, and what you can do to make sure your business stays healthy.

Why cash flow matters

A couple of months back, we shared our top turnaround strategies for businesses in crisis. The COVID-19 pandemic has changed the landscape for business owners, and the aftermath is likely to create continuing challenges.

There are times in the business life cycle when it’s all about growth and revenue. You need to grow your market share and bring in new customers, even if it means compromising profits for a while. Other times, you need to focus on efficiency and maximizing your profit percentages, so you keep as much of your revenue as possible. In either case, cash flow is crucial.

Regardless of how profitable you are paper, there are only certain kinds of paper you can spend. Accounts receivable don’t pay the bills - at least not yet. You need cold hard cash in the bank to stay afloat. Cash flow - how much money actually enters and exits your business each period - determines if you can pay your suppliers, cover your bills, and make payroll.

When cash flow suffers, you’re at a significant risk of going bankrupt or having to lay off staff to get by. But there are steps you can take to improve cash flow so you can get through tight times and capitalize on good times (you didn’t think this was all bad news, did you?)

Read Your Cash Flow Statement Regularly

Your accounting software should be able to generate a cash flow statement for you with the click of a button. But if you don’t know how to read a cash flow statement, we’re here to help.

Your cash flow statement starts with net income (from the income statement) and makes adjustments, so only actual cash transactions are included (not accruals). It also separates cash inflows and outflows from operations, investment activity, and financing activity so you know where everything is coming from and where it’s going.

Understanding what’s on your cash flow statement is critical to the survival of your business. If you’re not sure how to interpret the statement, make an appointment with your accountant to go over it. If you’re handling your own accounting, it may be time to consider working with an outsourced accounting firm that can give you the insight and advice you need to use your reports.

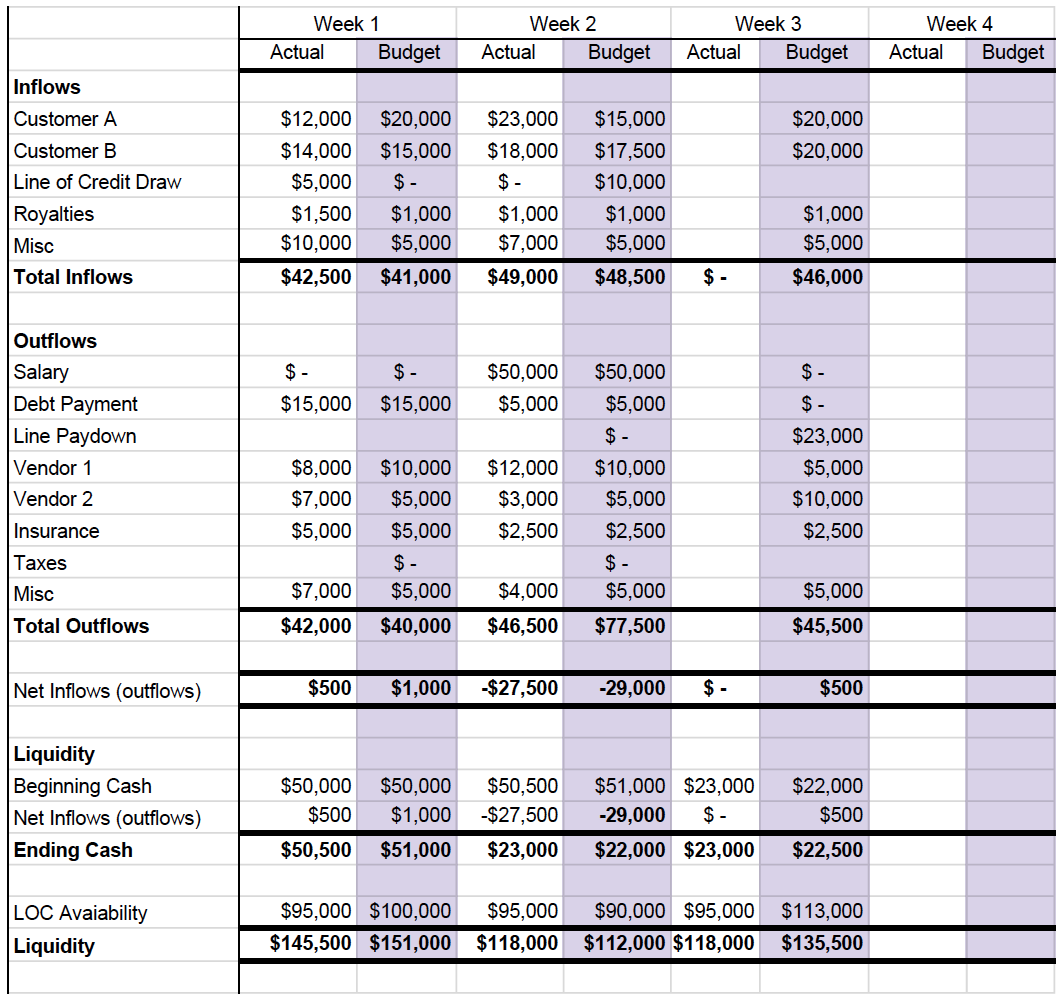

Example cash flow statement

Create a Rolling 13-week Cash Flow Projection

You can’t manage what you don’t measure, and you never want to be stuck making last-minute decisions. To give yourself time to plan and prepare proactively, you need a rolling cash flow projection.

The objective of a cash flow projection is to predict future cash in and out accurately. We recommend a 13-week cash flow projection so you can plan for the next full quarter.

You’ll want to update your projection as your actual results replace estimates, and as you begin to see further down the line. By updating the end of your projections regularly, you’ll be able to maintain visibility 13 weeks into the future from where you are now. No prediction is perfect (ask a meteorologist), but it’s better than nothing and gives you trustworthy guidance to prepare for the coming quarter.

Cash flow projections can be created in 2 ways - direct and indirect. Indirect cash flow projections are typically used in the longer term and are similar to the cash flow statement, only in the future. They take projected income information and adjust it to generate a projection of cash balances. This is theoretical, but for a longer time horizon, it’s the most accurate method.

For shorter projections, up to the 13-week cash flow mentioned above, direct cash flow is preferable. These projections are created directly from a list of future cash receipts and disbursements. Using actual transactions, you’ll achieve a more accurate forecast, but for a longer timeline, you are unlikely to know what will occur on a transaction basis.

Prepare for Shortfalls by Adjusting Spending or Reaching out to Vendors

With your 13-week cash flow projection in hand, you’re prepared for what lies ahead. You’ll see fluctuations in cash-on-hand as cash moves in and out of your business. In some cases, the cash outflows will take you below zero. We call these shortfalls.

No one likes a cash shortfall, but it’s much better to see one coming than to let it catch you by surprise. When you anticipate a deficit, you can tighten your belt and adjust your spending or reach out to vendors to defer a payment. Hopefully, these options will allow you to eliminate the shortfall and keep cash in the bank.

If you’re not able to prevent the shortfall, you’ll need to find cash elsewhere. Again, knowing in advance is crucial. You’ll know when and how much you need and when to reach out to your bank for appropriate gap financing. A revolving line of credit may be an option, although you should consider significant changes if you regularly slip into the red with your cash.

Make the Most of a Cash Surplus

Cash flow projections can also show you when you have a cash cushion. If you’ve got more cash available than you need to cover your outflows, you may be able to capitalize on the surplus to save money.

Check with vendors to see if you can get early payment discounts or a cheaper bulk. This may be more likely if they are struggling from the same economic downturn and in a cash crunch themselves. You can also use the excess cash to obtain extra inventory during a discount period or even acquire a competitor.

Consider the Impact of Inventory

If you’re in retail or e-commerce, inventory can have a significant impact on your cash flow. Although there can be benefits to buying extra at times - as we just discussed above - carrying too much inventory can tie up your cash and put you at increased risk. It can also lead to high costs for storage and a higher risk of shrinkage.

Make sure you optimize your inventory, so you stay as liquid as possible without running low and missing out on selling opportunities. Also, consider your best selling products and make sure they remain in stock, even if you cut it close on other product lines.

Maximize Your Labor Costs

Labor is one relatively inflexible cost. Cutting back on labor is sometimes unavoidable, although most companies would like to prevent it if possible. Make sure your team is used efficiently, and time is being analyzed. If the business is slow and cash is tight, your priorities may change, and team tasks need to adjust accordingly.

Idle time is the enemy. If your team isn’t able to keep busy, find new ways for them to use their time to create opportunity and cash flow. If you can’t justify the current payroll, sit down with Human Resources, and generate a plan to streamline the team to fit your needs.

The Wrap Up

By keeping your cash flow front and center and proactively planning for shortfalls and surpluses, you can weather the storm and make the most out of the sunny days.