Outsourced Accounting and Bookkeeping: What's the difference?

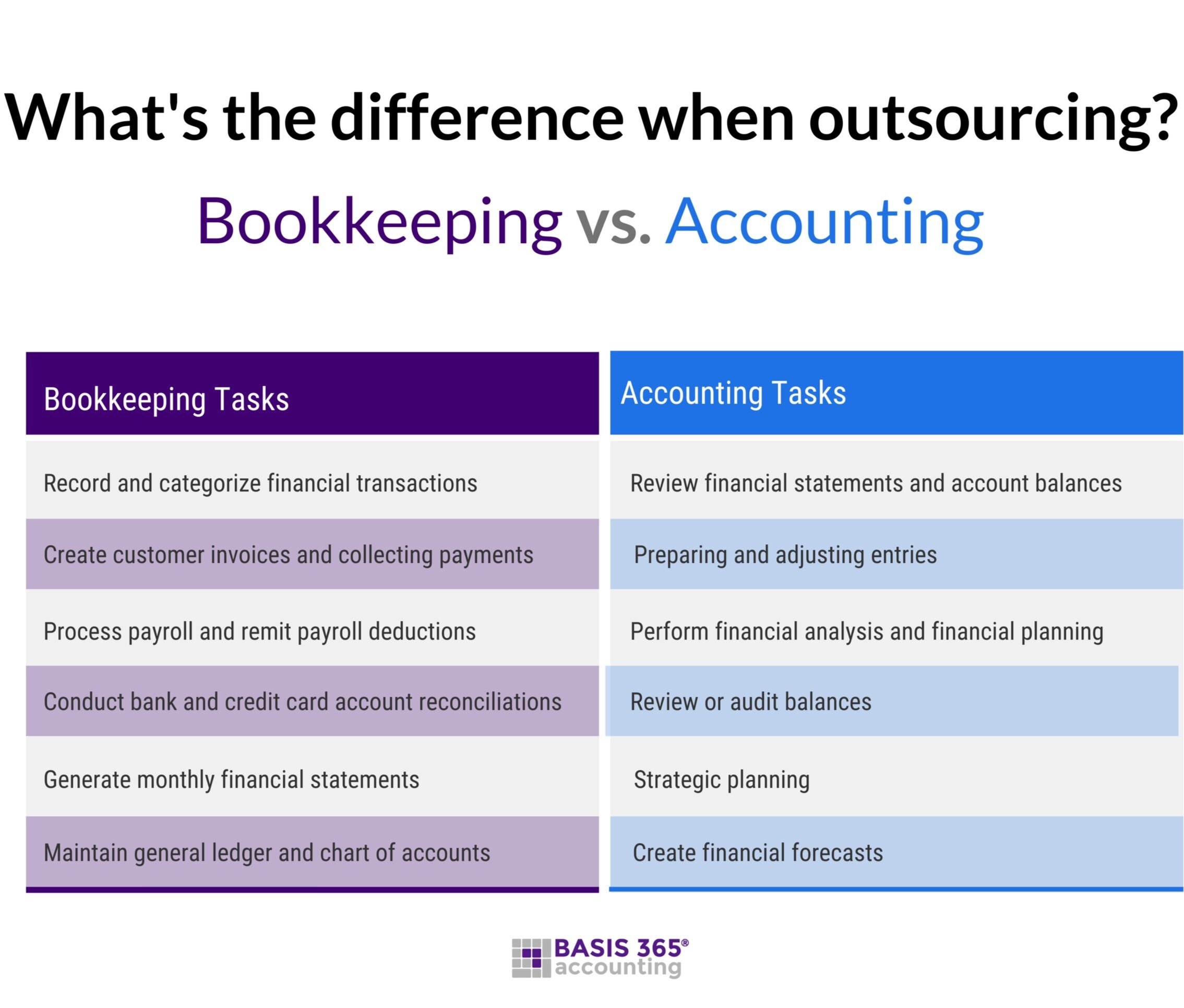

No matter what type of industry your business is categorized as, your company's legal structure, bookkeeping, and accounting teams are vital to the health of your organization. And while many think these terms are interchangeable, there is a massive difference between accountants and bookkeepers when it comes to managing your company's financial health.

Accounting and Bookkeeping: A Synergistic Relationship

As the name suggests, bookkeepers "keep" or manage your company's financial records, while accountants "account" or explain what's in them. As a result, accountants and bookkeepers work together to ensure your organization's finances are organized, up-to-date, and compliant. They are also analyzed to help elevate business performance.

Outsourced Bookkeepers understand basic accounting. As they are integral to recording the day to day and monthly financial activities surrounding your company’s:

Cash Flow

Accounts Payable and Receivable

Payroll

Financial Statements

Working with a designated outsourced accountant, meanwhile, is your best course of action when you need help analyzing and transforming those records into:

Financial forecasts, budgets, and projections

Strategic planning

Scalability

Why your business needs an outsourced bookkeeper

The potential to thrive and scale with any business relies heavily on having an organized and up-to-date set of financial records. The more systematic you have with your bookkeeping, the easier it becomes to promote your growth.

Because an outsourced bookkeeper's responsibilities revolve around reporting and recording your financial transactions, they lay the foundation for more detailed accounting analysis, which allows a business owner to make more educated and impactful decisions on the direction their business is taking.

The list of tasks an outsourced bookkeeper is often quite long and usually includes working with your company’s books to:

Receive and pay invoices

Verify and record expenses and employee expense reports

Generate invoices and statements for customers

Record customer payments and issue receipts

Process your accounts receivable and payable

Calculate and remit payroll deductions

Process paychecks and direct deposits

Reconcile bank accounts and credit card statements

Generate monthly financial statements including balance sheets, income and cash flow statements

By outsourcing these tasks to a qualified outsourced bookkeeper, you can now focus on what you do best, which is growing your company. In addition, most professional teams (like Basis 365) use powerful, cloud-based software such as XERO or QuickBooks to streamline the bookkeeping process and keep everyone in the know.

Working with a certified XERO or QuickBooks service provider is a great way to ensure you receive professional care that is designed to make your business run smoother.

Why your business needs an outsourced accountant

Many small or mid-sized companies find hiring a full-time accountant unnecessary; certain business events and growth stages warrant working with an accountant.

Year-end close out of your accounts

Financial planning, performance analysis, or cost management

Feasibility studies concerning taking on a new loan or capital investment

Revising your current business strategy

Auditing financial records if you’re thinking of selling your business

Benefiting from the best of both worlds

The best way to capitalize on the difference between outsourced accountants and bookkeepers is to understand that each relies on the other to provide your company with a comprehensive set of financial skills and services.

Partnering with an experienced outsourced bookkeeping firm will benefit your business by freeing up time for you to better manage your inventory, team, and your company's growth.

And while the right outsourced bookkeeping team will provide support and the data you need to make more informed business decisions, an outsourced accountant can help draw accurate conclusions from your financial data to keep your company consistently moving forward.

At Basis 365, we provide small to mid-sized business owners with bookkeeping and accounting support. We work closely with you to help you stay on top of your numbers and support growth. Chat with us to learn more about how we can help streamline your accounting and bookkeeping process.