COVID-19 Grant and Relief Options for Small Businesses

Since the beginning of the Coronavirus, small businesses across the U.S. have been looking for relief. Never before have so many companies been forced to restrict operations and limit foot traffic while trying to stay afloat.

One good thing to come of all this was the government's response and the CARES act's creation, which provides federal relief through the implementation of PPP loans. State and local governments are looking to help by providing stimulus grants and identifying places to turn to receive financial assistance.

With that in mind, here are a few coronavirus relief options for small businesses.

What are My Coronavirus Relief Options?

At the federal level, hundreds of billions of dollars are allocated to small businesses' relief through the CARES Act. These funds are being disbursed through programs like the Paycheck Protection Program, EIDL loans, Main Street Lending Program.

Paycheck Protection Program 2

As part of a new relief bill, Congress approved $284 billion for PPP2 funding, which started on December 21, 2020. The types of businesses and industries eligible for PPP loans have been expanded under the new bill. Companies that received the original PPP loan may be eligible for PPP2 if they can demonstrate at least a 25% reduction in gross receipts year over year and meet other requirements.

PPP loans are available in amounts equal to 250% of your average monthly payroll, up to $10 million. Interest rates are set at 1%.

EIDL

An Economic Disaster Injury Loan can cover fixed debts, payroll, and other bills. These loans are for businesses in every state. They are available in amounts up to $2 million and based on the company's actual economic injury, determined by the SBA. The interest rates are set at 3.75% for businesses, 2.75% for nonprofits, with repayment terms of up to 30 years.

Main Street Lending Program

If you are looking for an alternative to PPP loans, the CARES act has been allotted money to create the Main Street Lending Program, managed by the Federal Reserve, versus the SBA.

The Main Street Lending Program provides eligible small to mid-size businesses the ability to access affordable financing through local participating lenders. Loans are available in larger amounts compared to the amounts available for PPP and EIDL loans. Interest rates are set at the London Interbank Offer Rate of plus 3%

You can learn more about this stimulus program and how to apply on the Federal Reserve website.

IS my State or Local Government offering Stimulus Grants?

Many local and state government agencies have launched small business relief programs at the state and local level—including both loan and grant programs. These relief options are updated daily so that you can get in touch with your local Chamber of Commerce or other local agencies for more information.

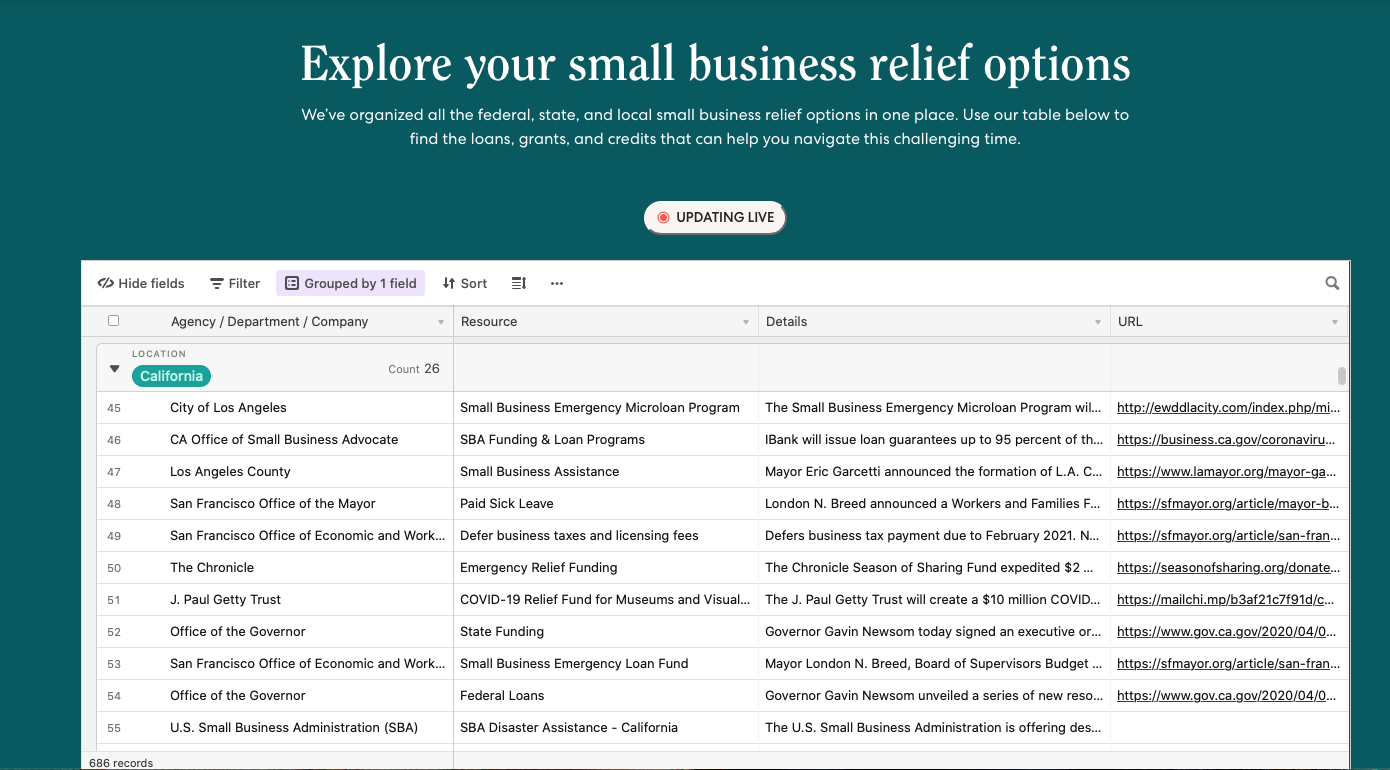

To assist in the process, Gusto developed a database and organized all the state and local small business relief options in one place. (You may also find some federally funded programs as well).

Use the database to find the loans, grants, and credits that can help you navigate this challenging time.

here’s no doubt that this is a financially taxing time for most small businesses across the country—but hopefully, one or more of the provided options can help you receive some of the relief you need.

It’s important to note that if you need personalized advice and assistance during this time, you can use the SBA’s Local Assistance tool to find local partners that can mentor, train, and provide up-to-date information for your business.