What Is the Difference Between Cash-Basis Accounting and Accrual Accounting?

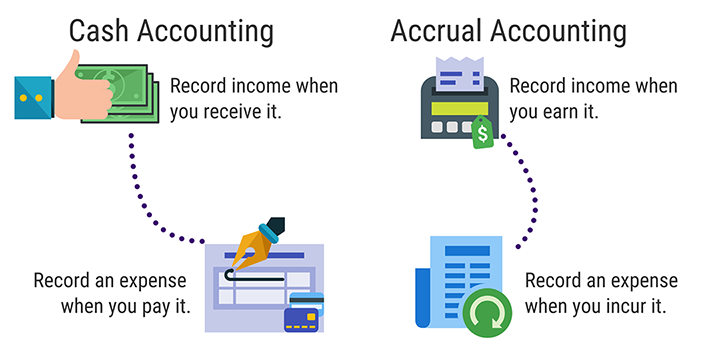

The main difference between cash-basis and accrual accounting is when revenue and expenses are recognized. Cash-basis accounting records these when money actually changes hands. Accrual accounting recognizes revenue and expenses as they occur, whether or not payments have been made yet.

If the difference between cash-basis and accrual accounting seem academic, it’s not. Here’s what it looks like in the real world and why it matters to your business:

How Cash-Basis Accounting Works

Cash-basis accounting is usually the default method for small businesses. This is because it’s easier and a little more intuitive. When you do the books on a cash-basis, you record revenue when you receive the money and expenses when you actually pay money out. Because everything is tied to cash, you have a good idea of what your cash flow is and how much cash you really have on hand.

One of the simplest - and sometimes most problematic - ways small businesses keep on eye on their finances is by logging in and checking their bank balance. When you use cash-basis accounting, this can be fairly accurate so it’s an easy habit to form. But it doesn’t tell the whole story.

How Accrual Accounting Works

Unlike the cash method, accrual accounting records revenue and expenses as they occur, not only when cash changes hands. In the U.S. accounting is expected to follow GAAP (generally accepted accounting principles) to make financial statements more uniform and understandable. Accrual accounting is a standard part of GAAP. Although most small businesses are able to use cash-basis accounting for tax purposes, banks, investors, and other stakeholders will expect accrual accounting so they can evaluate the health and risk level of your business.

Two of the most recognizable accounts in an accrual accounting system are “Accounts Receivable” and “Accounts Payable.” Let’s take a look at those to see what makes accrual accounting different.

Imagine that your company closed a $5,000 client project in April and completed the work during the month. The client has been billed but you haven’t received payment yet. That same project cost you $1000 in materials, which you had to pay for on the spot.

Here’s how accrual and cash-basis statements look side-by-side. Notice how the timing of revenue and expense recognition impacts the bottom line.

In reality, you’ve made $4,000 from your April project; not a bad profit. Your accrual-based statements show this in the form of a $5,000 account receivable. If you were using cash-basis, on the other hand, it would appear that you’ve lost $1,000 on the materials, since you haven’t booked any cash income yet. When you collect that payment in May, cash-basis would show a big profit, even though you didn’t do the project in May.

While cash-basis accounting is admittedly simpler, the accrual method gives a more accurate “picture” of what’s really going on in your company. It makes it much easier to match revenues to their related expenses - even if they were paid in different months - so you can track your true profitability.

What Does the IRS Require?

You may be wondering how these two methods stack up when it comes to tax time. For most small businesses, the accounting method used is optional. Under the recent Tax Cuts and Jobs Act, small businesses can file income taxes on a cash-basis up to an income of $25 million per year. Since most small businesses fall within that limit, it seems like another win for cash-basis. But is it?

Unfortunately, cash-basis accounting starts to fall short way before you reach the $25 million mark. It’s actually closer to $1 million per year. As businesses grow beyond this point, they need to make some big strategic decisions. They need their financial statements to provide insights into the business that cash-basis statements just don’t offer.

We’ll dig into that in just a second but here’s something to keep in mind for now: The IRS allows you to use a different method to calculate taxes than you use for your own internal tracking. In other words, your tax accountant can make a few conversions and file your taxes on a cash basis, while you enjoy the deeper insights of accrual accounting to help you run your business.

Here’s Why Everyone Actually Needs Both

The truth is, cash and accrual accounting both have their perks. Whichever method you use, you’ll probably end up secretly using a bit of both. Let me explain what I mean.

One of the biggest benefits of cash-basis accounting is that it gives you an accurate picture of just how much money is actually changing hands. If you don’t bring in cash as quickly as you dish it out, you’re going to be in trouble. If you have to pay vendors and suppliers right away but wait for your own customers to pay in 30 days, you’ll be forever chasing invoices and hoping the lights stay on.

That’s why accrual-based businesses need to utilize a statement of cash flows. It’s a way to keep track of cash while still recognizing accrued revenue and expenses. By tracking cash flow, you forecast any shortfalls where you may run out of money before your next payments come in.

Businesses who use the cash method sometimes rely on accrual principles, even if they don’t record them in the books. Remember accounts receivable and accounts payable? If you’ve got a customer who owes you money, you’re counting the days until you can expect that check, even though there’s nowhere to record a receivable account in your books. The same is true if you have a looming rent payment coming up.

The biggest shortcoming with cash-basis accounting is the struggle to measure your company’s performance. To really get a good look at how you’re doing, you need to establish and track KPIs (key performance indicators). Think of these as your business’s cholesterol, blood pressure, and heart rate. These will vary from business to business but you need to have the ability to track them and see how when they change to really understand the health of your business. Unfortunately, this is all but impossible on a cash basis.

To track your profitability, you need to know not only how much money goes in and out but how these amounts are connected. You need to know how much is tied to each period and the transactions from that period. This is the matching principle we talked about earlier. You need to match your expenses to the revenues they helped create. Accruals make this possible.

Which One is Right for You?

So, which accounting method is right for your business? If you run a super simple, small business - like a service-based sole-proprietorship - cash basis may be just fine for you. It can streamline your accounting process and save you time.

On the other hand, the accrual method is a must if:

You have inventory. Most businesses with inventory will need accrual accounting even for taxes. You’ll also need it to see your inventory value on the balance sheet and reflect the cost of goods sold on your income statement. Otherwise, you’ll have a very low month when you purchase your inventory and an unrealistically high month when you sell it.

You’ve paid up front for a service or for your rent and need to distribute that expense over the months you’ll actually use it (like splitting an annual subscription fee into 12 monthly expense entries).

Your clients have paid you in advance for work you haven’t done yet. You need to know how this impacts you, since owing them services is a form of liability.

Your business owns a fixed asset and wants to recognize and track depreciation over the asset’s useful life.

You’re looking for bank financing down the road (most banks will require accrual-based financials that follow GAAP in order to evaluate your risk and potential as a borrower.)

Conclusion

If this quick rundown has you thinking the accrual method may be better for your business, you’re probably right. Don’t be afraid to make the shift and start reaping the benefits.

You can reach out to the pros at Basis 365 to schedule your free consultation. We’ll talk about the details of your business model and let you know exactly what you could get out of the accrual method.